Tuition, food, transportation and other expenses add up quickly, and often it seems like there isn’t enough money to go around. The good news is that financial literacy and money management will keep more of your hard-earned dollars in your pocket, while allowing you to plan and save for the future!

The Office of Financial Aid has collected some resources to help you develop healthy financial habits.

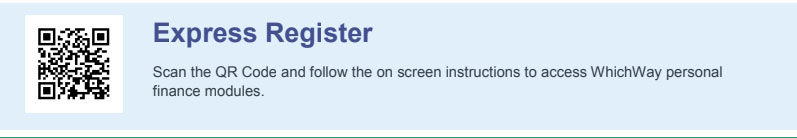

Mott Community College is partnering with Student Connections to offer students access to WhichWay, a financial wellness tool that will help you make a plan to manage your own money.

Access Code:

9146

You can also register at www.WhichWay.org

Upon completion of the module(s), contact a Financial Coach at Mott Community College.

Knowing how much money you have to spend gives you the freedom to make purchases doubt free and to support your financial priorities.

Explore this free guide to budgeting provided by BestColleges.com at Budgeting 101.

Entering college is the perfect time to develop healthy financial habits, and it all starts with creating and adhering to a budget.